Automotive Telematics Market To Reach $149.9 Billion in 2030

$149.9 billion in 2030. The market is predicted to grow at a 16.6% CAGR from 2020 to 2030 owing to the growing adoption of connected vehicles and the rising count of collaborations and partnerships. The fastest growth in this market will be observed in LAMEA in the coming years. This is because of the deployment of safety features in vehicles, connected vehicle technologies, and skyrocketing fleet telematics demand. A major driver in the automotive telematics market is the increasing number of partnerships and collaborations among telematics solution providers, numerous system providers, and original equipment manufacturers. For instance, Avis Budget Group Inc. collaborated with Verizon Communications Inc., to initiate an everything-in-one digital travel assistant, especially for consumers of Payless Car Rental Inc. and Avis Budget Group Inc. with the help of Verizon’s intricate 4G LTE network.

The greater adoption of technologies in the automotive telematics market will help its players to adapt to the changing dynamics and tastes & preferences of consumers. The amalgamation of 5G network innovations into telematics solutions offers lucrative growth chances for key players in this market owing to higher radio frequencies than the 4G network. There is a strong need for better network connectivity to ease the working of vehicle technologies as telematics solutions increase their complexity. The first company to incorporate a 5G network in the U.S. was Verizon Communications Inc. in December 2019.

North America had been the largest revenue generator for automotive telematics in the recent past attributed to greater support by the U.S. government are reaping profits in this market. These government initiations not only exhibit the futuristic development of this industry but also lay a better foundation for technical advancements. The U.S. dominated the market buoyed by advantageous policy frameworks and significant investments from both private and government sectors. The rising sales of trucks in the country would boost the requirement for automotive telemetrics in the future, yielding lucrative opportunities for the market players.

Hence, greater deployment of connected vehicles and a rising number of collaborations ,partnerships will drive the market.

A major driver in the automotive telematics market is the increasing number of partnerships and collaborations among telematics solution providers, numerous system providers, and original equipment manufacturers. For instance, Avis Budget Group Inc. collaborated with Verizon Communications Inc., to initiate an everything-in-one digital travel assistant, especially for consumers of Payless Car Rental Inc. and Avis Budget Group Inc. with the help of Verizon’s intricate 4G LTE network.

The greater adoption of technologies in the automotive telematics market will help its players to adapt to the changing dynamics and tastes & preferences of consumers. The amalgamation of 5G network innovations into telematics solutions offers lucrative growth chances for key players in this market owing to higher radio frequencies than the 4G network. There is a strong need for better network connectivity to ease the working of vehicle technologies as telematics solutions increase their complexity. The first company to incorporate a 5G network in the U.S. was Verizon Communications Inc. in December 2019.

North America had been the largest revenue generator for automotive telematics in the recent past attributed to greater support by the U.S. government are reaping profits in this market. These government initiations not only exhibit the futuristic development of this industry but also lay a better foundation for technical advancements. The U.S. dominated the market buoyed by advantageous policy frameworks and significant investments from both private and government sectors. The rising sales of trucks in the country would boost the requirement for automotive telemetrics in the future, yielding lucrative opportunities for the market players.

Hence, greater deployment of connected vehicles and a rising number of collaborations ,partnerships will drive the market.

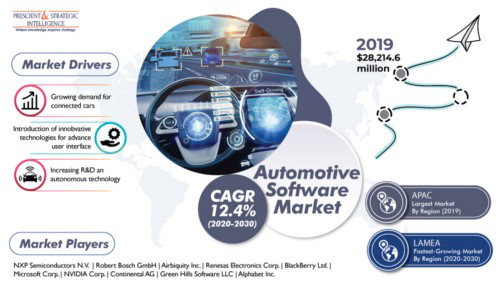

Why is Introduction of Connected Cars Driving Automotive Software Market?

Owing to urbanization, the demand for connected cars has increased significantly over the past few years. Take for instance the connected car market, which reached a value of about $72.5 billion in 2019. The demand for these cars is major increasing because of the surging concerns regarding security and safety, introduction of IoT in the automotive industry, and need for improved driving experience. IoT provides a number of advanced connectivity solutions and infotainment services for drivers.

Ascribed to this rising demand for connected cars, the automotive software market is registering significant growth as well. Automotive software include a number of requirements, such as cyber security, safety, performance, usability, and adaptability. It cover a wide array of applications from embedded real-time firmware to secured cloud solutions. The introduction of advanced technologies for improved user interface is also a major factor that is leading to the growing need for automotive software.

The global automotive software market is predicted to reach a value of $78,894.2 million by 2030, increasing from $28,214.6 million in 2016, advancing at a 12.4% CAGR during the forecast period (2020–2030). On the basis of software, the market is divided into OS and middleware, ADAS and autonomous driving (AD), body & energy, infotainment, connectivity, security, & connected services, and powertrain & chassis. Out of these, the ADAS and AD division accounted for the largest share of the market in the past.

Technologies such as automatic braking, lane assist, and ADAS considerably improve the driving experience, thereby making it safer than ever. These technologies further aid in decreasing traffic rule violations, which, in turn, leads to decline in the road accidents and improvement of the driver experience. Moreover, various companies are taking up R&D activities for deploying autonomous car that are majorly dependent on this software. These efforts for deploying ADAS and AD is positively impacting the market.

Geographically, the Asia-Pacific region held the major share of the automotive software market during the historical period (2014–2019), according to a P&S Intelligence report. The region is the major market for vehicles, along with which, the advancing economy and increasing purchasing power of customers is leading to growing need for advanced features in vehicles. The rising integration of advanced application, including auto-park assist, human-machine interface, and keyless entry, are creating need for automotive software in the region.

Why Cost Cutting Measures Are Driving Popularity of Ride-Hailing?

Till a little while ago, owning a car was considered an indicator of people’s economic status, and it still is in most of the countries. But with everything, from car and diesel/gasoline to insurance and regular maintenance, costing more now, many are shunning the idea of buying a car themselves and opting for shared mobility.However, people still want the comfort offered by a personal vehicle and, therefore, many avoid the crowded public transport. Thankfully, with smartphones equipped with internet connectivity, people can call cabs right to them, any time they want.

P&S Intelligence cites all these advantages while proclaiming that the worldwide ride-hailing market will grow from $50.4 billion in 2018 to $120.2 billion by 2024, at a CAGR of 13.0% between 2019 and 2024. Ride-hailing is the technical name of the transportation services offered by well-known companies such as Uber and Ola. It is where people book a cab via the mobile app of the company, and the driver takes them to their destination at their request. This is different from ride-sharing, where the cab has a fixed route, and it picks up more than one passenger on the way.

P&S Intelligence cites all these advantages while proclaiming that the worldwide ride-hailing market will grow from $50.4 billion in 2018 to $120.2 billion by 2024, at a CAGR of 13.0% between 2019 and 2024. Ride-hailing is the technical name of the transportation services offered by well-known companies such as Uber and Ola. It is where people book a cab via the mobile app of the company, and the driver takes them to their destination at their request. This is different from ride-sharing, where the cab has a fixed route, and it picks up more than one passenger on the way.

Browse detailed report on Ride-Hailing Market Size, and Business Strategies

One of the biggest reasons ride-hailing services are easily available is the government support being offered to service providers. Since this concept has the promise of reducing the number of personal cars on the roads, its successful implementation will not only reduce road traffic and leave more space for pedestrians, but also make the environment cleaner. More the personal cars on roads, more is the diesel/gasoline burnt, and higher is the amount of greenhouse gases discharged into the atmosphere.

With the increasing popularity of the concept, a shift is being witnessed in the commuting pattern. Till a little while ago, most people used these services occasionally, such as for visiting a relative or traveling to and from the railway station or airport. This is also why personal usage of ride-hailing services is higher than for business purposes. Now, the number of daily/weekly commuters using ride-hailing services is rising rapidly. This is because such shared mobility service providers are tying up with corporate houses and business to offer employees convenient commute between the office and home.

To cash in on the rising popularity of the concept, automakers are entering into partnerships with ride-hailing companies. For instance, in 2019, HyundaiMotor Company announced its intentions to provide Ola Cabs with electric vehicles (EVs) by 2021, for its operations in India. With EVs, the operational cost for service providers comes down significantly, as electricity is way cheaper than diesel and gasoline. Moreover, governments around the world are actively promoting the usage of EVs to reduce the harmful impact of fossil fuel burning on the environment.

Reefer Container Market Size and Growth Insights

With the increasing burden of diseases around the world, the demand for various pharmaceutical products, including vaccines, liquid medicines, biologics, pills, and raw materials and active ingredients, has risen. This factor is expected to help increase the global reefer container market size from 3,169.2 thousand twenty-foot equivalent units (TEU) in 2019 to 7,063.3 thousand TEUs by 2030, at an 8.0% CAGR between 2020 and 2030, according to the market research study published by P&S Intelligence.

This is because pharmaceuticals are extremely sensitive to temperature, which is why they need to be transported in refrigerated, or reefer, containers. In this regard, the improvements in the reefer technology and decrease in the cost of shipping are acting as key reefer container market drivers, by encouraging companies to send higher volumes of products via the sea. For instance, compared to just 5% in 2012, AstraZeneca plc was transporting almost 70% of its products via the sea in 2017.

Key Findings of Global Reefer Container Market

• Logistics companies prefer more-than-40-foot reefer containers

• Food products transported in highest volumes in reefer containers

• APAC is largest user of reefer containers, with trade routes redirecting toward it

• Growing pharmaceutical demand to propel market growth in future

• Presence of large established players making market consolidated

• LATAM to offer lucrative growth opportunities to containers manufacturers and lessors

During the COVID-19 pandemic, though the global demand for drugs has increased, the reefer container market has been negatively affected. Due to a reduction in the workforce as an infection prevention measure, port operations were severely hampered. Additionally, the demand for a large number of non-essential products declined massively, which led to significant losses for logistics companies. This is why they spent considerably lesser on buying and leasing reefer containers in 2020.

In the past, the food category dominated the reefer container market, under segmentation by industry. With the growing population pushing up the demand for food, the use of reefer containers to transport them over long distances is rising. This is because most of the food products, including fruits, vegetables, dairy, meats, seafood, and poultry, need to be shipped at sub-zero temperatures to prevent spoilage.

This is because pharmaceuticals are extremely sensitive to temperature, which is why they need to be transported in refrigerated, or reefer, containers. In this regard, the improvements in the reefer technology and decrease in the cost of shipping are acting as key reefer container market drivers, by encouraging companies to send higher volumes of products via the sea. For instance, compared to just 5% in 2012, AstraZeneca plc was transporting almost 70% of its products via the sea in 2017.

Key Findings of Global Reefer Container Market

• Logistics companies prefer more-than-40-foot reefer containers

• Food products transported in highest volumes in reefer containers

• APAC is largest user of reefer containers, with trade routes redirecting toward it

• Growing pharmaceutical demand to propel market growth in future

• Presence of large established players making market consolidated

• LATAM to offer lucrative growth opportunities to containers manufacturers and lessors

During the COVID-19 pandemic, though the global demand for drugs has increased, the reefer container market has been negatively affected. Due to a reduction in the workforce as an infection prevention measure, port operations were severely hampered. Additionally, the demand for a large number of non-essential products declined massively, which led to significant losses for logistics companies. This is why they spent considerably lesser on buying and leasing reefer containers in 2020.

In the past, the food category dominated the reefer container market, under segmentation by industry. With the growing population pushing up the demand for food, the use of reefer containers to transport them over long distances is rising. This is because most of the food products, including fruits, vegetables, dairy, meats, seafood, and poultry, need to be shipped at sub-zero temperatures to prevent spoilage.

Increasing Environmental Concerns Pushing the Demand for E- Buses

The electric bus market will experience significant growth in the years to come. The main factors accountable for the industrial growth include the increasing ecological apprehensions because of GHG emissions, decreasing cost and improving the working efficiency of batteries, and lasting cost aids of e-buses.

Battery electric buses had the highest demand in the recent past, and they will dominate the industry of electric buses in the future as well. This will be because of the growing support of the government like incentives, subsidies, and further monetary benefits, to endorse their acceptance. In addition, major makers are concentrating on the addition of BEBs to their portfolios, which is boosting the sales of these alternates over the world even more.

The North American electric bus market will observe the fastest growth in the future, because of the stringent emission norms. The U.S. has larger demand for BEBs, plug-in hybrid e- buses, and hybrid electric buses. In addition, the grants, financial incentives, and tax credits by the federal and state administrations pushed the sales of electric bus sales in the U.S. recently. Various other initiatives have also been initiated by the federal government to inspire the acceptance of e-buses, like toll charges exemption and, emission tests.

Progressions in instrumentation and actuation and sensing technologies led to the advent of automatic and semi-automatic transportation systems. Autonomous buses have features like light detection and ranging, odometer, GPS, and computer-aided vision, which help in perceiving the environs. Autonomous driving has become popular in the industry of e-bus because the technology offers improved efficiency and reduced costs. Due to all these benefits, OEMs like Navya SAS, Easy Mile SAS, AB Volvo, and SB Drive, are accepting automatic driving and working on developing autonomous bus shuttles.

Experts say that the average cost of Li-ion battery packs for large orders decreased from around $600 kWh in 2015 to around $150/kWh in the year 2020. As the battery is around 40% of the manufacturing cost of an e-bus, any decline in the price of the battery would help OEMs cut down the cost of the vehicles, therefore increasing their sales.

Due to growing environmental concerns, and the constantly declining prices of the batteries, the requirement for e-buses is on a constant rise.

Battery electric buses had the highest demand in the recent past, and they will dominate the industry of electric buses in the future as well. This will be because of the growing support of the government like incentives, subsidies, and further monetary benefits, to endorse their acceptance. In addition, major makers are concentrating on the addition of BEBs to their portfolios, which is boosting the sales of these alternates over the world even more.

The North American electric bus market will observe the fastest growth in the future, because of the stringent emission norms. The U.S. has larger demand for BEBs, plug-in hybrid e- buses, and hybrid electric buses. In addition, the grants, financial incentives, and tax credits by the federal and state administrations pushed the sales of electric bus sales in the U.S. recently. Various other initiatives have also been initiated by the federal government to inspire the acceptance of e-buses, like toll charges exemption and, emission tests.

Progressions in instrumentation and actuation and sensing technologies led to the advent of automatic and semi-automatic transportation systems. Autonomous buses have features like light detection and ranging, odometer, GPS, and computer-aided vision, which help in perceiving the environs. Autonomous driving has become popular in the industry of e-bus because the technology offers improved efficiency and reduced costs. Due to all these benefits, OEMs like Navya SAS, Easy Mile SAS, AB Volvo, and SB Drive, are accepting automatic driving and working on developing autonomous bus shuttles.

Experts say that the average cost of Li-ion battery packs for large orders decreased from around $600 kWh in 2015 to around $150/kWh in the year 2020. As the battery is around 40% of the manufacturing cost of an e-bus, any decline in the price of the battery would help OEMs cut down the cost of the vehicles, therefore increasing their sales.

Due to growing environmental concerns, and the constantly declining prices of the batteries, the requirement for e-buses is on a constant rise.

Browse detailed report on Electric Bus Market Size, and Regional Outlook

Electric Bus Charging Station Market Growth, Business Strategies, and Regional Outlook

The global electric bus charging station market is predicted to advance at a CAGR of 9.7% from 2018 to 2025 and generate a revenue of $12.3 billion in 2025. The key factors fueling the expansion of the market are the increasing implementation of various government regulations and initiatives in many countries, the rising deployment of electric buses in public transport fleets, and the soaring investments being made in the development of electric bus charging stations all over the world.

Based on type, the electric bus charging station market is categorized into inductive charging, depot charging, and opportunity charging. Out of these, the depot charging category had the highest sales volume in the past years, on account of the high preference of private and public transport agencies and companies toward overnight charging electric buses. These buses have very similar operational characteristics to diesel buses and are thus, highly preferred by transport companies. In the past years, the costs of the batteries installed in these buses were significantly higher than that of the ones installed in opportunity charging buses, on account of the larger sizes of these batteries. However, in recent years, the prices of these batteries have reduced considerably, which has, in turn, pushed up the sales of the overnight charging buses.

The global electric bus charging station market is heavily reliant on government support. In a majority of the countries around the world, government buses are mainly used for transit services, military transport, and public transport. The decisions to buy electric buses are mostly made either at the state level or the federal level. Many countries have made strong commitments in various international forums of increasing the number of electric buses in their transport fleets. As a result, many governments are implementing policies and granting subsidies, grants, and tax rebates for pushing up the deployment of electric buses in public transport fleets. For example, Columbus, the capital city of the U.S. state of Ohio, aims to deploy 200 electric vehicles in its municipal fleet and develop charging stations for these vehicles in the coming years.

Globally, the electric bus charging station market registered the highest growth in the Asia-Pacific (APAC) region during the last few years. This was because of the rapid surge of the electric bus industry in China. In recent years, the country saw the sales of 99.0% of the total number of electric buses sold all over the world. This subsequently created a huge requirement for electric bus charging facilities and infrastructure in the country and caused the boom of the market in the country in the past few years.

Based on type, the electric bus charging station market is categorized into inductive charging, depot charging, and opportunity charging. Out of these, the depot charging category had the highest sales volume in the past years, on account of the high preference of private and public transport agencies and companies toward overnight charging electric buses. These buses have very similar operational characteristics to diesel buses and are thus, highly preferred by transport companies. In the past years, the costs of the batteries installed in these buses were significantly higher than that of the ones installed in opportunity charging buses, on account of the larger sizes of these batteries. However, in recent years, the prices of these batteries have reduced considerably, which has, in turn, pushed up the sales of the overnight charging buses.

The global electric bus charging station market is heavily reliant on government support. In a majority of the countries around the world, government buses are mainly used for transit services, military transport, and public transport. The decisions to buy electric buses are mostly made either at the state level or the federal level. Many countries have made strong commitments in various international forums of increasing the number of electric buses in their transport fleets. As a result, many governments are implementing policies and granting subsidies, grants, and tax rebates for pushing up the deployment of electric buses in public transport fleets. For example, Columbus, the capital city of the U.S. state of Ohio, aims to deploy 200 electric vehicles in its municipal fleet and develop charging stations for these vehicles in the coming years.

Globally, the electric bus charging station market registered the highest growth in the Asia-Pacific (APAC) region during the last few years. This was because of the rapid surge of the electric bus industry in China. In recent years, the country saw the sales of 99.0% of the total number of electric buses sold all over the world. This subsequently created a huge requirement for electric bus charging facilities and infrastructure in the country and caused the boom of the market in the country in the past few years.

Detailed Analysis of the Electric Bus Charging Station Market Trends

Increasing Use of AI in Transportation Firms Reducing Operation Costs

The advent of autonomous vehicles has led to the wide-scale integration of artificial intelligence (AI) technology in the transportation sector. AI is a primary technology for autonomous driving systems, as it is the only technology that allows real-time and reliable identification of objects around the vehicle. Owing to the burgeoning demand for autonomous vehicles, leading automotive original equipment manufacturers (OEMs) are making hefty investments in the advancement of autonomous technology for optimizing self-driving technology.

Moreover, the soaring focus of transportation companies on reducing their operational costs will help the AI in transportation market advance at a CAGR of 16.5% during 2018–2023. The market was valued at $1.4 billion in 2017 and it is expected to reach $3.5 billion revenue by 2023. The integration of AI solutions aids in reducing costs and improves the operations of such companies. Additionally, the adoption of AI-enabled solutions, such as adaptive cruise control (ACC) systems and auto emergency braking (AEB) systems helps in reducing driver fatigue and preventing potential road accidents, thereby saving lives and curtailing product delivery times.

Besides, the increasing adoption of truck platooning will also fuel the integration of AI technology in the transportation sector in the coming years. Platooning is extremely necessary for achieving the objective of autonomous driving, and it offers several advantages such as curtailment in emission rates, reduction in fuel consumption, and improvement in safety features. In recent years, many countries have taken several initiatives to allow truck platooning to make road transport cleaner, safer, and more efficient in the future.

According to P&S Intelligence, North America will dominate the AI in transportation market in the foreseeable future, owing to the extensive sales of premium trucks in the region. The increasing regulatory developments related to compliance, safety, and accountability (CSA) and mounting investments being made in autonomous trucks in the U.S. will fuel the adoption of AI in the North American transportation sector in the coming years. For instance, the Automated Vehicles Comprehensive Plan developed by the U.S. Department of Transportation (USDOT) aims to prepare the country’s transportation system, promote collaborations and transparency, and modernize the regulatory environment.

Whereas, Asia-Pacific (APAC) is expected to integrate AI in the transportation sector at the fastest pace in the forthcoming years. This can be primarily attributed to the highest sales of trucks in the region and the rapid use of AI solutions in transportation in China and Japan. In the coming years, the transportation industry of Japan will adopt AI solutions at the highest rate, due to the maturing truck market of the country. Furthermore, China is also expected to integrate AI features in the trucks at a significant rate, owing to the growing digitization in the transport sector of the country.

Thus, the rising focus of transportation companies and governments on reducing operational costs and surging adoption of truck platooning will augment the integration of AI technology in the transportation sector in the foreseeable future.

Moreover, the soaring focus of transportation companies on reducing their operational costs will help the AI in transportation market advance at a CAGR of 16.5% during 2018–2023. The market was valued at $1.4 billion in 2017 and it is expected to reach $3.5 billion revenue by 2023. The integration of AI solutions aids in reducing costs and improves the operations of such companies. Additionally, the adoption of AI-enabled solutions, such as adaptive cruise control (ACC) systems and auto emergency braking (AEB) systems helps in reducing driver fatigue and preventing potential road accidents, thereby saving lives and curtailing product delivery times.

Besides, the increasing adoption of truck platooning will also fuel the integration of AI technology in the transportation sector in the coming years. Platooning is extremely necessary for achieving the objective of autonomous driving, and it offers several advantages such as curtailment in emission rates, reduction in fuel consumption, and improvement in safety features. In recent years, many countries have taken several initiatives to allow truck platooning to make road transport cleaner, safer, and more efficient in the future.

According to P&S Intelligence, North America will dominate the AI in transportation market in the foreseeable future, owing to the extensive sales of premium trucks in the region. The increasing regulatory developments related to compliance, safety, and accountability (CSA) and mounting investments being made in autonomous trucks in the U.S. will fuel the adoption of AI in the North American transportation sector in the coming years. For instance, the Automated Vehicles Comprehensive Plan developed by the U.S. Department of Transportation (USDOT) aims to prepare the country’s transportation system, promote collaborations and transparency, and modernize the regulatory environment.

Whereas, Asia-Pacific (APAC) is expected to integrate AI in the transportation sector at the fastest pace in the forthcoming years. This can be primarily attributed to the highest sales of trucks in the region and the rapid use of AI solutions in transportation in China and Japan. In the coming years, the transportation industry of Japan will adopt AI solutions at the highest rate, due to the maturing truck market of the country. Furthermore, China is also expected to integrate AI features in the trucks at a significant rate, owing to the growing digitization in the transport sector of the country.

Thus, the rising focus of transportation companies and governments on reducing operational costs and surging adoption of truck platooning will augment the integration of AI technology in the transportation sector in the foreseeable future.

Moreover, the soaring focus of transportation companies on reducing their operational costs will help the AI in transportation market advance at a CAGR of 16.5% during 2018–2023. The market was valued at $1.4 billion in 2017 and it is expected to reach $3.5 billion revenue by 2023. The integration of AI solutions aids in reducing costs and improves the operations of such companies. Additionally, the adoption of AI-enabled solutions, such as adaptive cruise control (ACC) systems and auto emergency braking (AEB) systems helps in reducing driver fatigue and preventing potential road accidents, thereby saving lives and curtailing product delivery times.

Besides, the increasing adoption of truck platooning will also fuel the integration of AI technology in the transportation sector in the coming years. Platooning is extremely necessary for achieving the objective of autonomous driving, and it offers several advantages such as curtailment in emission rates, reduction in fuel consumption, and improvement in safety features. In recent years, many countries have taken several initiatives to allow truck platooning to make road transport cleaner, safer, and more efficient in the future.

According to P&S Intelligence, North America will dominate the AI in transportation market in the foreseeable future, owing to the extensive sales of premium trucks in the region. The increasing regulatory developments related to compliance, safety, and accountability (CSA) and mounting investments being made in autonomous trucks in the U.S. will fuel the adoption of AI in the North American transportation sector in the coming years. For instance, the Automated Vehicles Comprehensive Plan developed by the U.S. Department of Transportation (USDOT) aims to prepare the country’s transportation system, promote collaborations and transparency, and modernize the regulatory environment.

Whereas, Asia-Pacific (APAC) is expected to integrate AI in the transportation sector at the fastest pace in the forthcoming years. This can be primarily attributed to the highest sales of trucks in the region and the rapid use of AI solutions in transportation in China and Japan. In the coming years, the transportation industry of Japan will adopt AI solutions at the highest rate, due to the maturing truck market of the country. Furthermore, China is also expected to integrate AI features in the trucks at a significant rate, owing to the growing digitization in the transport sector of the country.

Thus, the rising focus of transportation companies and governments on reducing operational costs and surging adoption of truck platooning will augment the integration of AI technology in the transportation sector in the foreseeable future.

Moreover, the soaring focus of transportation companies on reducing their operational costs will help the AI in transportation market advance at a CAGR of 16.5% during 2018–2023. The market was valued at $1.4 billion in 2017 and it is expected to reach $3.5 billion revenue by 2023. The integration of AI solutions aids in reducing costs and improves the operations of such companies. Additionally, the adoption of AI-enabled solutions, such as adaptive cruise control (ACC) systems and auto emergency braking (AEB) systems helps in reducing driver fatigue and preventing potential road accidents, thereby saving lives and curtailing product delivery times.

Besides, the increasing adoption of truck platooning will also fuel the integration of AI technology in the transportation sector in the coming years. Platooning is extremely necessary for achieving the objective of autonomous driving, and it offers several advantages such as curtailment in emission rates, reduction in fuel consumption, and improvement in safety features. In recent years, many countries have taken several initiatives to allow truck platooning to make road transport cleaner, safer, and more efficient in the future.

According to P&S Intelligence, North America will dominate the AI in transportation market in the foreseeable future, owing to the extensive sales of premium trucks in the region. The increasing regulatory developments related to compliance, safety, and accountability (CSA) and mounting investments being made in autonomous trucks in the U.S. will fuel the adoption of AI in the North American transportation sector in the coming years. For instance, the Automated Vehicles Comprehensive Plan developed by the U.S. Department of Transportation (USDOT) aims to prepare the country’s transportation system, promote collaborations and transparency, and modernize the regulatory environment.

Whereas, Asia-Pacific (APAC) is expected to integrate AI in the transportation sector at the fastest pace in the forthcoming years. This can be primarily attributed to the highest sales of trucks in the region and the rapid use of AI solutions in transportation in China and Japan. In the coming years, the transportation industry of Japan will adopt AI solutions at the highest rate, due to the maturing truck market of the country. Furthermore, China is also expected to integrate AI features in the trucks at a significant rate, owing to the growing digitization in the transport sector of the country.

Thus, the rising focus of transportation companies and governments on reducing operational costs and surging adoption of truck platooning will augment the integration of AI technology in the transportation sector in the foreseeable future.

What Kinds of Anode Materials Do Automotive Li-Ion Batteries Have?

Key factors such as the soaring sales of electric vehicles (EVs) and reducing prices of electrodematerials will drive the anode material for automotive lithium-ion (Li-ion) battery market at a CAGR of 5.7% during the forecast period (2020–2030). The market generated $707.2 million in 2019, and it is expected to reach $1,348.6 million by 2030. In recent years, academic institutions and original equipment manufacturers (OEMs) have started investing in research and development (R&D) forbetter anode materials than the ones currently in use.

These entities have realized that the improvement in Li-ion batteriescenters on enhancing the abilities of theircomponents. OEMs have,therefore, are partneringwith and investingin the research programs of academic institutions that are working toward the development of such products. These investments facilitate the creation of batteries with a long life, high performance, high power density, low cost, and eco-friendly nature. One such way that R&D has unearthed is using different concentrations of silicon and graphite, to do away with the technical problems associated with anodes predominantly containing Li or silicon.

In the coming years, these batteries will be largely installed in passenger cars and commercial vehicles. Li-ion batteries are being incorporated in electric commercial vehicles, such as buses and trucks, as they require a battery with a high capacity and energy density. Automakers now have the option of installing high-capacityLi-ion batteries that have artificial graphite, amorphous carbon, natural graphite, lithium–titanate oxide (LTO), and silicon compoundsintheir anode.

On the other hand, Europe is expected to display the fastest growth in the anode material for automotive lithium-ion battery market in the forecast period. This can be ascribed to the joint efforts by the European Union (EU), commercial lenders, and battery manufacturers to create a conducive charging ecosystem and become self-sufficient in battery manufacturing. For example, in 2018, the European Investment Bank approved aloan toNorthvolt Ett to start a battery Gigafactory in Sweden. Similarly, the German government is planning to increase the domestic production of Li-ion batteries for EVs.

Thus, the increasing R&D activities and reducing cost of the anode materials will ultimately fuel the sales of EVs in the foreseeable future, by making them cheaper for the masses.

These entities have realized that the improvement in Li-ion batteriescenters on enhancing the abilities of theircomponents. OEMs have,therefore, are partneringwith and investingin the research programs of academic institutions that are working toward the development of such products. These investments facilitate the creation of batteries with a long life, high performance, high power density, low cost, and eco-friendly nature. One such way that R&D has unearthed is using different concentrations of silicon and graphite, to do away with the technical problems associated with anodes predominantly containing Li or silicon.

In the coming years, these batteries will be largely installed in passenger cars and commercial vehicles. Li-ion batteries are being incorporated in electric commercial vehicles, such as buses and trucks, as they require a battery with a high capacity and energy density. Automakers now have the option of installing high-capacityLi-ion batteries that have artificial graphite, amorphous carbon, natural graphite, lithium–titanate oxide (LTO), and silicon compoundsintheir anode.

On the other hand, Europe is expected to display the fastest growth in the anode material for automotive lithium-ion battery market in the forecast period. This can be ascribed to the joint efforts by the European Union (EU), commercial lenders, and battery manufacturers to create a conducive charging ecosystem and become self-sufficient in battery manufacturing. For example, in 2018, the European Investment Bank approved aloan toNorthvolt Ett to start a battery Gigafactory in Sweden. Similarly, the German government is planning to increase the domestic production of Li-ion batteries for EVs.

Thus, the increasing R&D activities and reducing cost of the anode materials will ultimately fuel the sales of EVs in the foreseeable future, by making them cheaper for the masses.

U.S. Electric Bus Market Revenue to Cross $1,924.8 Million by 2026

The U.S. electric bus market value is predicted to surge from an estimated $490.6 million in 2021 to $1,924.8 million by 2026, demonstrating a CAGR of 31.4% from 2021 to 2026. According to the market research report published by P&S Intelligence. The major factors fueling the expansion of the market are the implementation of strict regulatory measures for reducing emissions, provision of federal funding for augmenting the deployment of zero-emission buses, declining battery costs, improving operational efficiencies, and various long-term economic benefits of electric buses.

Key Findings of U.S. Electric Bus Market Report

• The plunging costs of lithium-ion (Li-ion) batteries are also driving the progress of the market. As per industry experts, the average cost of Li-ion battery cells for large orders fell from nearly $1,000 per kilowatt-hour (kWh) in 2010 to around $310/kWh in 2019.

• The battery electric bus (BEB) category held the largest share, under the vehicle type segment, in the past, as BEBs are the cleanest of all such automobiles.

• The inductive charging category, within the charging type segment, is predicted to demonstrate the fastest growth in the coming years. This is credited to the ability of this technology to rapidly charge electric buses.

• The COVID-19 pandemic caused huge disruptions in the U.S. electric bus market, as the lockdowns imposed by the federal and state governments affected the import of electronic and electrical components from China and hampered automotive production.

• The launch of projects and programs such as the American Fuel Cell Bus (AFCB) Project and the National Fuel Cell Bus Program (NFCBP) by the U.S. government is a major trend in the industry.

• The market is consolidated in nature, and the players are actively focusing on geographical expansions and partnerships to strengthen their position.

BYD and Levo Mobility, which is a joint venture of Stonepeak Partners L.P., Evolve Transition Infrastructure LP, and Nuvve Holding Corp., announced a partnership in May 2021. Under it, Levo will buy up to 5,000 medium- and heavy-duty, vehicle-to-grid (V2G)-enabled battery electric vehicles (BEVs) over a period of five years.

Key Findings of U.S. Electric Bus Market Report

• The plunging costs of lithium-ion (Li-ion) batteries are also driving the progress of the market. As per industry experts, the average cost of Li-ion battery cells for large orders fell from nearly $1,000 per kilowatt-hour (kWh) in 2010 to around $310/kWh in 2019.

• The battery electric bus (BEB) category held the largest share, under the vehicle type segment, in the past, as BEBs are the cleanest of all such automobiles.

• The inductive charging category, within the charging type segment, is predicted to demonstrate the fastest growth in the coming years. This is credited to the ability of this technology to rapidly charge electric buses.

• The COVID-19 pandemic caused huge disruptions in the U.S. electric bus market, as the lockdowns imposed by the federal and state governments affected the import of electronic and electrical components from China and hampered automotive production.

• The launch of projects and programs such as the American Fuel Cell Bus (AFCB) Project and the National Fuel Cell Bus Program (NFCBP) by the U.S. government is a major trend in the industry.

• The market is consolidated in nature, and the players are actively focusing on geographical expansions and partnerships to strengthen their position.

BYD and Levo Mobility, which is a joint venture of Stonepeak Partners L.P., Evolve Transition Infrastructure LP, and Nuvve Holding Corp., announced a partnership in May 2021. Under it, Levo will buy up to 5,000 medium- and heavy-duty, vehicle-to-grid (V2G)-enabled battery electric vehicles (BEVs) over a period of five years.

The U.S. bus market Will Reach about $11,238 Million by 2030

The U.S. bus market size stood at over $7,453 million in 2021. This will increase to about $11,238 million by 2030, propelling at a growth rate of about 5% in the years to come. This can be credited to the quick urbanization and rising population, together with the cumulative government outlay on the upgradation of vehicles for public transport. Furthermore, the obtainability of local, state, and centralized funding and the large count of school buses help the market to grow.

The school buses had the largest share of revenue, approximately 55%, in the U.S. bus market in 2021, and will continue the same trend also in the near future. This is for the reason that these buses are the main form of mass transportation in the U.S. Nearly 480,000 school buses were on the roads in 2021 in the U.S., more than transit buses roughly 7 to 1. Additionally, the surging acceptance of e- buses for school helps the market growth in the U.S.

Accompanied by environmental assistance, it has considerably lesser crash rates and lesser severity of crashes than personal travel. Commuting by public transportation is a lot safer than commuting by personal vehicle. Furthermore, people can minimalize the chance of an accident by over 90% just by taking public transport compared to a car. These factors help in improving the growth of the U.S. bus market significantly.

8.1–10 m bus will be the largest category during the forecast period. This type of bus has better mileage and seating comfort than other kinds of buses. In addition, e- buses in this length make added sense for environmental protection than moderately smaller buses.

The buses with 30–50 seats have the largest share of revenue in the U.S. bus market, and they will record the highest growth rate of approximately 5.0%, in the years to come. This is due to the fact that these can carry more travelers, use a smaller amount of fuel, and are economically competitive.

Because of rapid urbanization and population, a growing number of school buses has boosted the demand for buses in the U.S.