The Importance of Levulinic Acid in Various Industry

The ongoing depletion of fossil resources and the absence of substitutes for the substances made from oil have increased the demand for levulinic acid. A rising number of compounds, like levulinic acid and bioethanol, are being utilized to produce alternative fuels from biomass, which is also reducing the world's dependency on oil.

Levulinic acid is an organic substance that results from the breakdown of cellulose. It is made from manure, brewery waste, and biomass waste and is known as a keto acid. Levulinic acid is seen as a substitute for goods derived from petroleum. The levulinic acid market is predicted to hit $61.04 million by 2030.

Levulinic acid is also created by the oxidation of ketones and the acidic hydrolysis of furfuryl alcohol. With the expansion of research and development efforts across several chemical sectors, levulinic acid which is derived from biological sources is becoming more developed.

According to the U.S. Food and Drug Administration, levulinic acid and its salts are extensively utilized in cosmetic and personal care products because they are water-soluble.

Precursors for medicines, plasticizers, and a variety of other additives include levulinic acid. Levulinic acid is most commonly used to create aminolevulinic acid, a biodegradable herbicide used in South Asia. The usage of levulinic acid in cosmetics is another significant use. Levulinic acid's major derivative, ethyl levulinate, is widely utilized in perfumes and fragrances.

Levulinic acid may be made using a variety of techniques. Levulinic acid was formerly produced using expensive methods with a relatively low yield. Levulinic acid may now be produced using biomass thanks to the development of the Biofine manufacturing method, and the yield it produces is also substantially higher than that of conventional processes.

Moreover, levulinic acid manufacturing is supported by government initiatives as a result of growing environmental concerns and efficient economic growth.These regulations frequently represent the nation's goals and comparative advantage initiatives. By encouraging public procurement, employment creation, and the move from the linear to the circular economy, it seeks to advance the bioeconomy.

According to the U.S. Food and Drug Administration, levulinic acid and its salts are extensively utilized in cosmetic and personal care products because they are water-soluble.

Precursors for medicines, plasticizers, and a variety of other additives include levulinic acid. Levulinic acid is most commonly used to create aminolevulinic acid, a biodegradable herbicide used in South Asia. The usage of levulinic acid in cosmetics is another significant use. Levulinic acid's major derivative, ethyl levulinate, is widely utilized in perfumes and fragrances.

Levulinic acid may be made using a variety of techniques. Levulinic acid was formerly produced using expensive methods with a relatively low yield. Levulinic acid may now be produced using biomass thanks to the development of the Biofine manufacturing method, and the yield it produces is also substantially higher than that of conventional processes.

Moreover, levulinic acid manufacturing is supported by government initiatives as a result of growing environmental concerns and efficient economic growth.These regulations frequently represent the nation's goals and comparative advantage initiatives. By encouraging public procurement, employment creation, and the move from the linear to the circular economy, it seeks to advance the bioeconomy.

Why Do Water Treatment Plants Use Flocculants and Coagulants?

Flocculants and coagulants are used to filter solid particles from liquids in the water treatment, pulp and paper, and oil and gas industries. At present, water treatment plants are increasingly consuming flocculants to facilitate the clumping of particles in wastewater and coagulants to neutralize the electrical charges that are present in water and accumulate the dissolved substances to form larger clumps that can be eliminated through various solid elimination processes, such as filtration and clarification. Thus, the increasing consumption of such chemicals in water treatment plants, on account of the surging demand for clean water, will help the flocculants and coagulants market advance at a CAGR of 5.4% during the forecast period (2018–2023). The market revenue stood at $10,270.2 million in 2017, and it is projected to reach $14,225.3 million by 2023. The mounting demand for clean water can be ascribed to the growing global population and toughening government laws on the supply of treated water.

In the last few years, flocculants were consumed in higher quantities than coagulants because is it easier to separate or filter solid particles from contaminated liquids via flocculation than coagulation. In the flocculation process, the solution is delicately mixed to collect the clumps created during the coagulation process and form larger clumps, which are easy to filter when they settle down. Anionic, cationic, and non-ionic flocculants and organic and inorganic coagulants are used for water treatment.

The application segment of the flocculants and coagulants market is classified into mineral and extraction, oil and gas, pulp and paper, water and wastewater treatment, and others, such as medical and agriculture. Under this segment, the water and wastewater treatment category accounted for the largest share in 2017, and it is also expected to witness the fastest growth during the forecast period. This can be attributed to the high-volume consumption of these chemicals in municipal water treatment plants owing to the toughening government regulations mandating the supply of clean water.

In contemporary times, BASF SE, SUEZ, National Aluminium Company Limited, Kemira Oyj, Evonik Industries AG, Akzo Nobel N.V., Kurita Water Industries Ltd., Ecolab Inc., Chinafloc, SNF s.a.s., Feralco AB, and Solvay SA have emerged as the largest producers of flocculants and coagulants. In the coming years, they will increase their operations in Thailand, China, Indonesia, and India due to the soaring number of power plant and housing projects, booming manufacturing industry, and increasing construction activities in these countries.

Thus, the increasing consumption of such chemicals in water treatment plants, on account of the surging demand for clean water, will help the flocculants and coagulants market advance at a CAGR of 5.4% during the forecast period (2018–2023). The market revenue stood at $10,270.2 million in 2017, and it is projected to reach $14,225.3 million by 2023. The mounting demand for clean water can be ascribed to the growing global population and toughening government laws on the supply of treated water.

In the last few years, flocculants were consumed in higher quantities than coagulants because is it easier to separate or filter solid particles from contaminated liquids via flocculation than coagulation. In the flocculation process, the solution is delicately mixed to collect the clumps created during the coagulation process and form larger clumps, which are easy to filter when they settle down. Anionic, cationic, and non-ionic flocculants and organic and inorganic coagulants are used for water treatment.

The application segment of the flocculants and coagulants market is classified into mineral and extraction, oil and gas, pulp and paper, water and wastewater treatment, and others, such as medical and agriculture. Under this segment, the water and wastewater treatment category accounted for the largest share in 2017, and it is also expected to witness the fastest growth during the forecast period. This can be attributed to the high-volume consumption of these chemicals in municipal water treatment plants owing to the toughening government regulations mandating the supply of clean water.

In contemporary times, BASF SE, SUEZ, National Aluminium Company Limited, Kemira Oyj, Evonik Industries AG, Akzo Nobel N.V., Kurita Water Industries Ltd., Ecolab Inc., Chinafloc, SNF s.a.s., Feralco AB, and Solvay SA have emerged as the largest producers of flocculants and coagulants. In the coming years, they will increase their operations in Thailand, China, Indonesia, and India due to the soaring number of power plant and housing projects, booming manufacturing industry, and increasing construction activities in these countries.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/flocculants-and-coagulants-market/report-sample

How Are India and China Propelling Sale of Lubricant for Mining and Quarry Applications?

The Indian Bureau of Mines states that 23690 thousand tons, 3971 thousand tons, 4135 thousand tons, 38437 thousand tons, 1079 thousand tons, 566 thousand tons, 39030 thousand tons, 206494 thousand tons, and 4889 tons of bauxite, chromite, copper ore, diamond, fluorite, gold ore, graphite, iron ore, and kyanite, respectively, were mined in India in the financial year (FY) 2018–2019. Further, the Census Economic Information Center (CEIC) reveals that 4,324,215,796.000 metric tons of minerals were produced in China in December 2019. Additionally, the liberalization of mineral policies and rapid technological advancements in the mining sector will also facilitate the consumption of lubricants globally. Owing to these reasons, mining companies will consume a significant volume of mineral oil lubricants, bio-based lubricants, and synthetic lubricants for bauxite mining, coal mining, iron ore mining, precious metals mining, and rare earth mineral mining. The aforementioned lubricants are used for the proper functioning of the engine, hydraulic, gear, and transmission equipment. In the coming years, the largest quantity of such lubricants will be used in the coal mining sector due to the rising need for mining equipment in this industry and burgeoning demand for coal for power generation in emerging economies, such as India, China, and Indonesia. For instance, the Ministry of Power under the Government of India states that coal consumption in thermal power plants of the country increased from 690.246 million tons in FY 2017–2018 to 707.387 million tons in FY 2019–2020.

In contemporary times, the mining industry uses lubricants produced by Schaeffer Manufacturing Co., Blue Star Lubrication Technology LLC, BP PLC, D-A Lubricant Company Inc., Royal Dutch Shell Plc, Busler Enterprises Inc., Chevron Corporation, Total S.A., and Exxon Mobil Corporation for mining and quarry applications. Presently, companies, such as Chevron Corporation, BP PLC, and Exxon Mobil Corporation, are focusing on imparting knowledge about brands among consumers through print and visual media, to reach out to a greater number of end users.

Globally, the Asia-Pacific (APAC) region dominates the lubricants market for mining and quarry applications, wherein China consumes the highest volume of such lubricants. Furthermore, the European region is led by Russia, whereas, North America is dominated by the U.S. Additionally, in the Middle East and African (MEA) region, Saudi Arabia uses the maximum quantity of lubricants for mining and quarry applications due to the presence of numerous oil fields in the country.

Thus, the increasing mining activities in developing countries and liberalization of mining policies will result in the large-scale consumption of lubricants for mining and quarry applications in the forthcoming years.

In the coming years, the largest quantity of such lubricants will be used in the coal mining sector due to the rising need for mining equipment in this industry and burgeoning demand for coal for power generation in emerging economies, such as India, China, and Indonesia. For instance, the Ministry of Power under the Government of India states that coal consumption in thermal power plants of the country increased from 690.246 million tons in FY 2017–2018 to 707.387 million tons in FY 2019–2020.

In contemporary times, the mining industry uses lubricants produced by Schaeffer Manufacturing Co., Blue Star Lubrication Technology LLC, BP PLC, D-A Lubricant Company Inc., Royal Dutch Shell Plc, Busler Enterprises Inc., Chevron Corporation, Total S.A., and Exxon Mobil Corporation for mining and quarry applications. Presently, companies, such as Chevron Corporation, BP PLC, and Exxon Mobil Corporation, are focusing on imparting knowledge about brands among consumers through print and visual media, to reach out to a greater number of end users.

Globally, the Asia-Pacific (APAC) region dominates the lubricants market for mining and quarry applications, wherein China consumes the highest volume of such lubricants. Furthermore, the European region is led by Russia, whereas, North America is dominated by the U.S. Additionally, in the Middle East and African (MEA) region, Saudi Arabia uses the maximum quantity of lubricants for mining and quarry applications due to the presence of numerous oil fields in the country.

Thus, the increasing mining activities in developing countries and liberalization of mining policies will result in the large-scale consumption of lubricants for mining and quarry applications in the forthcoming years.

Get More details@ Lubricants Market for Mining and Quarry Applications Business Opportunities and Top Manufacture

Why 1,3-Butylene Glycol is Ruling the Roost in Beauty Products?

Butylene glycol for skin is used in numerous beauty and skincare products. From make-up to cream, and shampoo to serums, it’s everywhere, which is why it’s significant to comprehend what exactly it is and what it does. It performs countless functions from acting as a humectant to giving a uniform consistency to products, making it an important ingredient.

It’s no surprise that the beauty industry is continually recalibrating its products. Removing one ingredient and adding another. This is a reason butylene glycol is this popular. Frequently used as an auxiliary for propylene glycol, butylene glycol is less irritating and as effective. Because of its being gentle and its capability to hydrate the skin, it’s perfect for many skin types.

What is Butylene Glycol?

1,3-Butylene glycol is an organic compound that is classified as a diol. A neutral, water-soluble liquid, it has four atoms of carbon and two alcohol groups. The formula is CH3CH(OH)CH2CH2OH!

Butylene Glycol is also a solvent. As a solvent, it supports other ingredients breaking down when put in water. This might not seem all that significant or a big deal, but solvent is pretty necessary for all beauty products. Basically, without a solvent, they will all be like undercooked oatmeal, clumpy, lumpy, and impossible to use. Moreover, butylene glycol aids in steady and thickening other ingredients. Just as it acts as a solvent, it also helps soothe and thicken ingredients so the cosmetics aren’t a

soupy mess

.

Butylene glycol also suits most skin types. Owing to its non-irritating properties, it is really handy for sensitive skin. Not just that, but it is low on the comedogenic scale. Rated “1” on the comedogenic scale, it’s improbable to clog pores, making it an inordinate component for oily skin. And, due to its hydration powers, it also does the job for those having dry skin.

How To Use Butylene Glycol

You will mostly find butylene glycol in numerous beauty and skincare products. As it is used both as a hydrating agent and one keeping products stable, it’s used in shampoo, conditioner, moisturizers, sunscreens, serums, and other skin care products.

And if you are a skincare DIY’er, you can use it as a stabilizer for your products.

Finally, it might also impress you to know that butylene glycol is vegan. It is now also derived synthetically, and is completely vegan!

All because of the benefits, the demand for 1,3-Butylene glycol is on the increase and it will reach a value above $269 million by 2030, with a growth rate of about 6%.

Browse detailed report on 1,3-Butylene Glycol Market Size, and Regional Outlook

Growing Need to Improve Yield Production Leads to Rising Consumption of Agricultural Lubricants

In 2021, the agricultural lubricants industry contributes $3,011.3 million, and it is projected to rise at a rate of 4.1% from 2021 to 2030, to capture $4,332.8 million revenue. It is due to the rising adoption of modern farming practices, agricultural process mechanization, and the growing need to increase yield production. In addition, farming activities and related products are projected to rise in the near future, led by the increasing cost of farm labor. Moreover, the rising rate of farm mechanization and high-performance synthetic grease appeal are projected to cause industry proliferation. Moreover, significant technological advancements in the agronomical sector are resulting in increased consumption of agricultural lubricants. Numerous innovative approaches and strategies, such as the usage of inorganic compost have enhanced yield production, with increased efficiency, and a decline in operational cost. Therefore, modern machinery and technology are utilized on the farm for reducing operational time, and effort, and increase production.

Government agencies have introduced a number of farmer subsidy schemes in emerging countries such as Mexico, India, and others, for helping farmers in buying harvesters, tractors, power sprayers, threshers, paddy transplanters, and other equipment. More sophisticated machinery is utilized by farmers which results in rising agricultural machine lubricating product demand.

Moreover, significant technological advancements in the agronomical sector are resulting in increased consumption of agricultural lubricants. Numerous innovative approaches and strategies, such as the usage of inorganic compost have enhanced yield production, with increased efficiency, and a decline in operational cost. Therefore, modern machinery and technology are utilized on the farm for reducing operational time, and effort, and increase production.

Government agencies have introduced a number of farmer subsidy schemes in emerging countries such as Mexico, India, and others, for helping farmers in buying harvesters, tractors, power sprayers, threshers, paddy transplanters, and other equipment. More sophisticated machinery is utilized by farmers which results in rising agricultural machine lubricating product demand.To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/agricultural-lubricants-market/report-sample

For example, India offers subsidies for 30% to 50% procurement of farming machinery to increase the adoption of modern equipment for crop cultivation. It thus drives the lubricants demand and lures the manufacturers to expand their operations in other countries as well.

APAC generates a significant revenue share in the agricultural lubricants industry, and it is projected to experience rapid growth in the near future, due to the rising establishment of manufacturing facilities in the region. It is led by economic labor and high consumer demand. Thus, the industry players are increasingly concentrating on better investments, and plans for catering to the growing demand for agricultural lubricants.

Over 56% of the global population depends on APAC for agricultural production for sustenance. The massive size of the farm causes high equipment sales, which results in increasing demand for agricultural lubricants.

Biodegradable lubricants are expected to experience significant growth, rising at a rate of 4.9%, in the coming future. The increasing popularity of biodegradable oils is predicted to lure industry players. Bio-based products come with superior lubricating qualities to mineral-based primary assets with biodegradability and renewability. In addition, the demand for heavy-duty machines is constantly rising for agricultural operations.

Browse Full Report Agricultural Lubricants Market Geographical Insight

Graphene Market Will Hit 1,88.8 Million By 2030

The graphene market is projected to reach 1,88.8 million by 2030. The major factors behind the growth of this market are, growing demand for graphene from electronics and electrical applications, and also the rising demand from medical industry for new application. Based on form, the power category had the largest market share in recent years. This can be credited to the usage of its powder form in several technology, such as, printing and storage batteries. Additionally, it is way easier to handle powdered graphene in comparison of its dispersion and flake form. Commercialization of graphene has increased in past years, credited to several factors like, R&D for its new applications and growing availability of graphene across the globe. Moreover, many graphene forms, such as graphene sheets and graphene flakes, have also started to be used in digital displays, sports goods, conductive inks, and automotive coatings, among others, initially graphene was used for lab testing only.

Graphene is majorly used in electronics and electrical industry, credited to the usage of this in transistors, microchips and print circuits. Due to its favourable qualities, like high strength and electrical conductivity. Because of its increasing usage in flexible devices the demand for graphene is surging. This is because of the special properties of graphene that allow the devices to be folded or rolled as per needed and exceptional chartersticks provided by graphene-based electronic devices.

The increasing adoption graphene for applications in composite materials for electrical & electronic devices, and automotive vehicles & lightweight aircraft, and also the commercialization of graphene are the major drivers of this industry, and such factors also shows the growing future.

Commercialization of graphene has increased in past years, credited to several factors like, R&D for its new applications and growing availability of graphene across the globe. Moreover, many graphene forms, such as graphene sheets and graphene flakes, have also started to be used in digital displays, sports goods, conductive inks, and automotive coatings, among others, initially graphene was used for lab testing only.

Graphene is majorly used in electronics and electrical industry, credited to the usage of this in transistors, microchips and print circuits. Due to its favourable qualities, like high strength and electrical conductivity. Because of its increasing usage in flexible devices the demand for graphene is surging. This is because of the special properties of graphene that allow the devices to be folded or rolled as per needed and exceptional chartersticks provided by graphene-based electronic devices.

The increasing adoption graphene for applications in composite materials for electrical & electronic devices, and automotive vehicles & lightweight aircraft, and also the commercialization of graphene are the major drivers of this industry, and such factors also shows the growing future. To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/graphene-market/report-sample

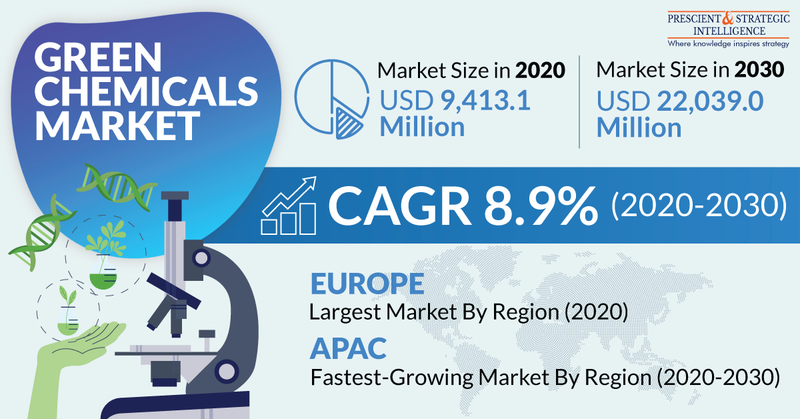

Green Chemicals Market to Generate $22,039.0 Million Revenue by 2030

Prominent factors such as the rising demand for bio-based packaging materials and growing concerns over fossil fuel depletion are projected to drive the green chemicals market at a CAGR of 8.9% during 2020–2030. The market was valued at $9,413.1 million in 2020 and it is expected to generate $22,039.0 million revenue by 2030. Green chemicals are non-toxic and do not emit sulfur dioxide or particulate matter, as they are derived from plant or animal waste. The product segment of the green chemicals market is classified into organic acids, biosolvents, bioalcohols, bioplolymers, and others, such as biolubricants and biosurfactants. Among these, the bioalcohols category generated the highest revenue in 2020, and it is expected to continue this trend throughout the forecast period. This can be owed to the large-scale consumption of bioethanol as an alternative fuel for the spark-ignition engines of automobiles. Besides, the increasing use of bioethanol in the production of alcoholic beverages, such as gin, beer, whiskey, vodka, and brandy, will also contribute to the growth of this category.

At present, the players in the green chemicals market are launching new products to attain a notable position. For example, in October 2019, Braskem introduced a new 'I'm green' recycled polypropylene in the U.S. to include its entire portfolio of circular economy products as a part of its commitment to aid in the transformation of the plastic chain from a linear economy into a circular economy. In a circular economy, the materials are utilized, disposed of, and then recycled in a circular manner.

According to P&S Intelligence, Europe accounted for the largest share in the green chemicals market in 2020, and it is expected to maintain its dominance throughout the forecast period. This can be ascribed to the high-volume consumption of green chemicals in the personal care, packaging, food and beverages, and automotive industries, owing to the increasing environmental concerns in the region. Moreover, the surging focus of the chemical industry on developing sustainable and eco-friendly solutions will also boost the market growth in Europe.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/green-chemicals-market-outlook/report-sample